Health Coverage for when you need it the most!

Critical Illness Coverage

Critical illness insurance is a type of insurance policy that pays a lump sum benefit upon the diagnosis of a covered critical illness, such as cancer, heart attack, stroke, or major organ transplant. The benefit can be used for any expenses related to the diagnosis, including medical bills, lost income, and out-of-pocket expenses. Critical illness insurance is meant to provide financial support during a difficult time, and it can help ease the financial burden associated with a critical illness. Unlike traditional health insurance, critical illness insurance is a standalone policy and is not tied to the payment of specific medical bills.

Hospital Indemnity

A hospital indemnity plan is a type of insurance plan that pays a fixed amount of money directly to the policyholder if they are hospitalized due to illness or injury. This type of plan is designed to help cover the out-of-pocket expenses associated with a hospital stay that are not covered by traditional health insurance, such as deductibles, co-payments, and other expenses. A hospital indemnity plan typically pays a predetermined amount for each day the policyholder is hospitalized, regardless of the actual cost of the hospitalization. The amount of coverage and daily benefit amount can vary depending on the plan and the insurance company. Some hospital indemnity plans may also offer additional benefits, such as coverage for outpatient services, emergency room visits, or ambulance services. Overall, a hospital indemnity plan can provide a valuable supplement to traditional health insurance and help offset the financial burden of a hospitalization. It's important to carefully review the details of any hospital indemnity plan before purchasing to ensure it meets your individual needs and budget.

Accidental Injury

An accidental injury policy is a type of insurance policy that provides financial protection in the event that the policyholder suffers an accidental injury. This type of policy is designed to supplement traditional health insurance by providing additional benefits specifically for accidental injuries. Accidental injury policies typically pay out a lump sum benefit to the policyholder in the event of an accidental injury, such as a broken bone, burn, or concussion. The amount of the benefit varies depending on the specific policy and the severity of the injury. In addition to the lump sum benefit, accidental injury policies may also provide coverage for medical expenses related to the injury, such as emergency room visits, hospital stays, surgeries, and rehabilitation. One of the advantages of an accidental injury policy is that it covers injuries that may not be covered by traditional health insurance, such as injuries sustained while participating in certain sports or recreational activities. It can also help offset the cost of deductibles, copayments, and other out-of-pocket expenses associated with an accidental injury. It's important to carefully review the details of any accidental injury policy before purchasing to ensure it meets your individual needs and budget. Some policies may have exclusions or limitations, and may not cover certain types of injuries or activities.

Medicare

Medicare Enrollment Periods

Turning 65 - Initial Enrollment Period

The Medicare Initial Enrollment Period (IEP) is the time frame during which individuals become eligible for Medicare and can enroll in the program for the first time. The Medicare IEP begins three months before an individual's 65th birthday and continues for seven months. During this time, individuals can enroll in Original Medicare (Part A and Part B) and, if desired, enroll in a Medicare Supplement (Medigap) policy, a Medicare Advantage plan, or a Medicare Prescription Drug plan.

AEP - Annual Enrollment Period

The Medicare Annual Enrollment Period (AEP) is a time frame each year during which individuals with Medicare can make changes to their coverage, enroll in new coverage, or switch from one type of coverage to another. The Medicare AEP runs from October 15 to December 7 each year. During this time, individuals can enroll in a new Medicare Advantage plan, switch from one Medicare Advantage plan to another, enroll in a Medicare prescription drug plan, or make changes to their existing coverage.

OEP - Open Enrollment Period

The Medicare Open Enrollment Period (OEP) is a time frame each year during which individuals with Medicare can make changes to their Medicare Advantage coverage, switch from one Medicare Advantage plan to another, or enroll in a new Medicare Advantage plan. The Medicare OEP runs from January 1 to March 31 each year. During this time, individuals can make changes to their existing coverage, enroll in a new Medicare Advantage plan, or switch from one plan to another without being subject to medical underwriting or pre-existing condition limitations.

SEP - Special Enrollment Period

The Medicare Special Enrollment Period (SEP) is a time frame during which individuals with Medicare can enroll in or make changes to their Medicare coverage outside of the regular enrollment periods. The Medicare SEP is available to individuals who meet certain eligibility criteria, such as those who lose employer-sponsored coverage, move to a new area, or experience certain life events that affect their Medicare coverage. During a Medicare SEP, individuals can enroll in a new Medicare Advantage plan, switch from one Medicare Advantage plan to another, enroll in a Medicare prescription drug plan, or make changes to their existing coverage. The length of a Medicare SEP varies depending on the individual's circumstances and the reason for the SEP.

Medicare Explained

Medicare is a federal health insurance program in the United States designed to provide health coverage for individuals who are 65 years of age or older, individuals with certain disabilities, and individuals with End-Stage Renal Disease (ESRD). Medicare is funded through payroll taxes and premiums paid by beneficiaries, and it provides coverage for a wide range of medical services, including hospital stays, doctor visits, and preventive care. There are four parts to Medicare: Part A, which covers hospital stays and inpatient care; Part B, which covers doctor visits and other medical services; Part C, also known as Medicare Advantage, which is a private insurance option that provides all the benefits of Parts A and B; and Part D, which covers prescription drugs. Medicare is an important resource for individuals who are eligible and it provides a critical safety net for those who need access to health care.

HMO?

An HMO (Health Maintenance Organization) is a type of managed healthcare system where healthcare services are provided to members through a network of providers contracted by the HMO. In an HMO, members are usually required to choose a primary care physician and get referrals for specialist care. The focus is on preventative care and cost containment, often at the tradeoff of less flexibility in terms of choosing healthcare providers.

But what will it cost Me?

The cost of a Health Maintenance Organization (HMO) plan to a beneficiary can include:

1. Monthly premium: This is the amount that the beneficiary must pay on a monthly basis to maintain their insurance coverage.

2. Deductible: This is the amount that the beneficiary must pay out of pocket before their insurance coverage starts.

3. Copayments: A copayment is a fixed dollar amount that the beneficiary must pay for a specific service.

4. Out-of-pocket maximum: This is the maximum amount that the beneficiary will be responsible for in a given year, after which their insurance will cover 100% of the costs.

HMOs typically have lower out-of-pocket costs compared to other types of insurance plans, but they also have more restrictions on the providers that beneficiaries can see. Beneficiaries must choose a primary care physician (PCP) who will manage their care and refer them to specialists when needed. The actual costs for an HMO plan will depend on factors such as the specific plan, the beneficiary's age, location, and healthcare needs. It's important for beneficiaries to review their plan details and compare costs and benefits before enrolling in an HMO plan.

PPO?

A PPO (Preferred Provider Organization) is a type of managed healthcare system in which healthcare providers offer services to members at discounted rates. Unlike an HMO, PPOs typically do not require members to choose a primary care physician or get referrals for specialist care. Instead, members can choose from a network of healthcare providers and visit any provider they wish without a referral. This often results in more flexibility and wider access to healthcare providers, but it may also result in higher out-of-pocket costs for the member.

But what will it cost Me?

The cost of a Preferred Provider Organization (PPO) plan to a beneficiary can include:

1. Monthly premium: This is the amount that the beneficiary must pay on a monthly basis to maintain their insurance coverage.

2. Deductible: This is the amount that the beneficiary must pay out of pocket before their insurance coverage starts.

3. Copayments and Coinsurance: A copayment is a fixed dollar amount that the beneficiary must pay for a specific service, while coinsurance is a percentage of the total cost of a service that the beneficiary must pay.

4. Out-of-pocket maximum: This is the maximum amount that the beneficiary will be responsible for in a given year, after which their insurance will cover 100% of the costs.

The actual costs for a PPO plan will depend on factors such as the specific plan, the beneficiary's age, location, and healthcare needs. It's important for beneficiaries to review their plan details and compare costs and benefits before enrolling in a PPO plan.

Medicaid

Medicaid is a joint federal and state program that provides health insurance coverage to eligible low-income individuals and families. The program is designed to help people who cannot afford to pay for their own medical care. Eligibility for Medicaid is based on income and financial need, and each state has its own rules for determining eligibility. Medicaid covers a wide range of health services, including doctor visits, hospital stays, prescription drugs, and long-term care. The program is funded by both the federal government and the states, and the specific benefits and services offered can vary from state to state. The goal of Medicaid is to provide access to quality health care for those who need it most.

What is a Drug Formulary??

A drug formulary is a list of prescription drugs that are covered by a specific health insurance plan or pharmacy benefit management company. The formulary typically includes both generic and brand-name medications and is organized into different tiers, with each tier having different levels of cost-sharing for the patient. The goal of a formulary is to provide coverage for the most effective and safe drugs while controlling the costs of prescription drug coverage for the insurance plan

Medicare Supplement Coverage

Medicare supplemental coverage (also known as Medigap) is a private insurance policy that helps cover some of the costs not covered by Original Medicare (Parts A and B), such as copays, deductibles, and coinsurance. It can help fill the "gaps" in Original Medicare coverage, hence the name. There are 10 standardized Medigap plans available, each with a different set of benefits.

Standalone prescription Drug plans

A Medicare Stand-Alone Prescription Drug Plan (PDP) is a type of Medicare Part D plan that provides only coverage for prescription drugs, and not the other benefits provided by Medicare Parts A and B. Stand-Alone PDPs are an option for individuals who are already enrolled in traditional Medicare (Parts A and B) and who need additional coverage for prescription drugs. Stand-Alone PDPs are offered by private insurance companies and they have been approved by Medicare. They provide coverage for a wide range of prescription drugs, but they do not cover everything, and there may be some costs that are not covered by the plan, such as co-payments and deductibles. Stand-Alone PDPs are an important option for individuals who are enrolled in traditional Medicare and who need additional coverage for prescription drugs.

Medicare Part....What Letter??

Medicare Part A

Medicare Part A is a component of the Medicare program in the United States. It is the part of Medicare that provides coverage for hospital stays and inpatient care, including care in a hospital, skilled nursing facility, and hospice. Part A is considered to be the "core" coverage of Medicare and it covers a wide range of services related to hospital stays, including room and board, meals, nursing care, and other hospital services. Part A is funded through payroll taxes and premiums, and most individuals who are eligible for Medicare are eligible for Part A coverage as well. Part A is an important component of the Medicare program and it provides essential coverage for individuals who need access to health care services during a hospital stay.

Medicare Part B

Medicare Part B is a component of the Medicare program in the United States. It is the part of Medicare that provides coverage for medical services and supplies that are considered medically necessary, including doctor visits, lab tests, and medical equipment. Part B coverage is optional, and individuals who are eligible for Medicare must choose to enroll in Part B and pay a monthly premium to receive coverage. Part B covers a wide range of medical services, but it does not cover everything, and there may be some costs that are not covered by Part B, such as co-payments and deductibles. Part B is an important component of the Medicare program and it provides critical coverage for individuals who need access to medical services and supplies that are not covered by Part A.

Medicare Part C

Medicare Part C, also known as Medicare Advantage, is a type of private health insurance that is designed to provide the same benefits as Medicare Parts A and B. Medicare Advantage plans are offered by private insurance companies that have been approved by Medicare, and they must provide at least the same level of coverage as Parts A and B, but many Medicare Advantage plans offer additional benefits, such as coverage for prescription drugs and dental care, vision, hearing and more. Medicare Advantage plans are an alternative to traditional Medicare and they can provide more comprehensive coverage for individuals who need access to health care services. Enrollment in a Medicare Advantage plan is optional, and individuals who are eligible for Medicare must choose to enroll in a Medicare Advantage plan in order to receive coverage. Medicare Advantage plans are an important option for individuals who are looking for additional benefits and more comprehensive coverage than what is available through traditional Medicare.

Medicare Part D

Medicare Part D is a component of the Medicare program in the United States. It is the part of Medicare that provides coverage for prescription drugs. Part D is a optional coverage, and individuals who are eligible for Medicare must choose to enroll in Part D and pay a monthly premium to receive coverage. Part D covers a wide range of prescription drugs, but it does not cover everything, and there may be some costs that are not covered by Part D, such as co-payments and deductibles. Part D is an important component of the Medicare program and it provides critical coverage for individuals who need access to prescription drugs that are not covered by Parts A and B.

Medicare Advantage - Special Need Plans

Medicare D-SNP (Dual-Eligible Special Needs Plan)

Medicare D-SNP (Dual-Eligible Special Needs Plan) is a type of Medicare Advantage plan that is specifically designed for individuals who are eligible for both Medicare and Medicaid (known as "dual-eligibles"). These plans provide both Medicare and Medicaid benefits, and they may also offer additional benefits such as vision, dental, or hearing coverage. D-SNP plans have specific eligibility criteria, and enrollment is limited to individuals who meet those criteria, such as having both Medicare and Medicaid, and/or being enrolled in a specific Medicaid program. The goal of D-SNP plans is to provide a coordinated, integrated approach to care for dual-eligibles.

Medicare I-SNP (Institutional Special Needs Plan)

Medicare I-SNP (Institutional Special Needs Plan) is a type of Medicare Advantage plan that is specifically designed for individuals who reside in a long-term care facility, such as a nursing home or assisted living facility. These plans provide both Medicare and Medicaid benefits, and they may also offer additional benefits such as vision, dental, or hearing coverage. I-SNP plans have specific eligibility criteria, and enrollment is limited to individuals who meet those criteria, such as residing in a long-term care facility and being eligible for both Medicare and Medicaid. The goal of I-SNP plans is to provide a coordinated, integrated approach to care for individuals in long-term care facilities.

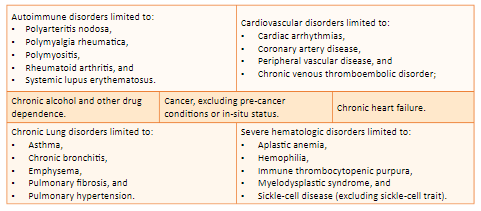

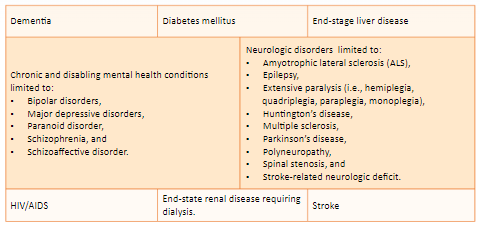

Medicare C-SNP (Chronic Special Needs Plan)

Medicare C-SNP (Chronic Special Needs Plan) is a type of Medicare Advantage plan that is specifically designed for individuals with specific chronic conditions, such as heart failure, diabetes, or end-stage renal disease. These plans provide both Medicare and, in some cases, Medicaid benefits, and they may also offer additional benefits such as vision, dental, or hearing coverage. C-SNP plans have specific eligibility criteria, and enrollment is limited to individuals who meet those criteria, such as having a specific chronic condition. The goal of C-SNP plans is to provide a coordinated, integrated approach to care for individuals with specific chronic conditions.

National Producer #19939270

Licensed in the following States

MA, NY, PA, OH, WV, MD, DE, VA, SC, GA, FL MI, & TX

58 Eastbrook Rd. Ronks, PA 17572

Copyright 2024 The Frey Group All Rights Reserved